Back in the 1600s, Sir Thomas Browne said “Charity begins at home.”

Have you noticed all the commercials for the American Red Cross? They crawl out of the woodwork whenever there’s a flood, tornado, or other disaster. The way disasters are increasing we’ll no doubt be seeing more of them. They raised hundreds of millions after the earthquake in Haiti and built a total of six houses there. Six...

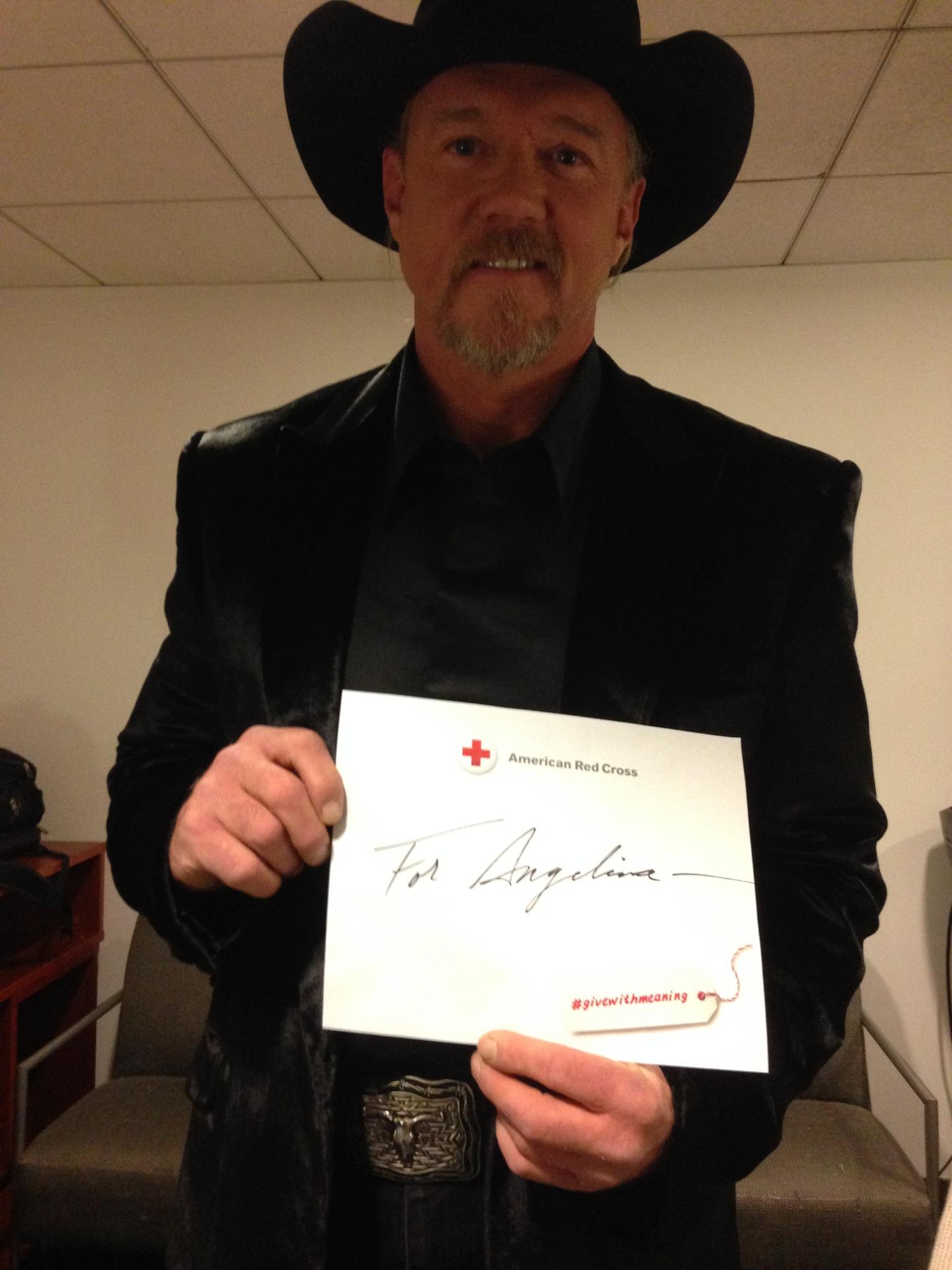

When Trace Adkins endorsed them a few weeks ago, he explained it was because his house burned down while he was on tour in Alaska, and the Red Cross took care of his family while he was away.

Hmmm. I’m having trouble thinking of anyone who would need the Red Cross’s help less than a country singer with a reported net worth of $16,000,000.

Wouldn’t you think he could have simply said,

‘Honey, check in to the nicest suite at the Ritz and I’ll be home in a couple days’?

But no, Red Cross was there with the coffee and blankets, and I imagine we’re supposed to believe they put his family up at the nearest Motel Six. A good investment for them, since they have so far collected more than a million dollars via Mr. Adkins’ endorsement.

And lord knows the poor charity needs it: The Red Cross's tax return is public, and here’s some of what it says:

- Total income: $3,154,538,143

- Total Salaries, other compensation, employee benefits: 1,723,401,133

Wait, that can’t be right… more than half of every dollar they collected went to employee salaries? I’m no accountant, maybe I’m reading the form wrong. Let me dig deeper.

The president and CEO, Gail McGovern, is paid a salary of $500,000 per year.

What exactly does a CEO do? I’ve never been a CEO, but I bet I could learn. The Red Cross could spend $50,000 putting me through CEO school, then pay me one fourth what they’re paying Gail, and they’d save enough to put up the Adkin’s family in the Beverly Hills Hilton for a year!

But maybe Gail’s an anomaly? Nope.

Part 7, section A, line 2 of the Red Cross’ return (page 11 of the pdf) asks:

- “Total number of individuals who received more than $100,000 of reportable compensation from the organization?”

- And the Red Cross’ answer? 1,359.

So, multiply $100k times 1,359, that's like $140 Million to high-end employees.

I wonder how much those employees donate to charity? If they donate to Red Cross, is that considered a charitable contribution or just job security?

Now, in fairness, it should be noted that Sir Thomas Browne, quoted above, was born in Cheapside, a place not exactly overrun with charities. If you saw the movie “A Knight’s Tale” you know that was the wrong side of the tracks in England. So when he said “charity begins at home,” I’m sure he never envisioned a world where "charity" could be such a lucrative business.

Bill K. Underwood is the author of several books, all available

at Amazon.com. You can help support this site by purchasing a book.

A former co-worker of mine got pretty upset when I explained to him that not all donated money go to said charitable cause. When you have people collecting salaries, that much should be obvious. In my estimation, he was pretty upset that parts of his donations were lining pockets.

ReplyDeleteIf the charity or charitable arm is comprised of unpaid volunteers, then you can be sure about where exactly the money is going.